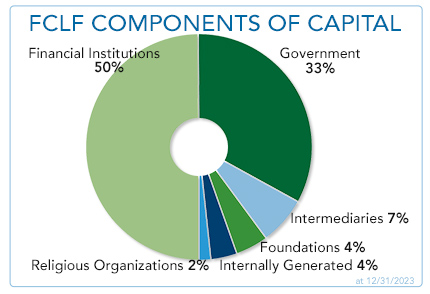

WE CAN TAILOR AN INVESTMENT TO MEET YOUR NEEDS

Grants.

Capital Grants allow FCLF to leverage other forms of capital on a 1:4 ratio. Operating Support Grants support FCLF’s operating expenses, both lending and administrative.

Equity Equivalent (EQ2) Investments.

Equity Equivalent (EQ2) Investments are a hybrid of debt and capital grants. EQ2 Investments are long-term renewable subordinated debt with equity-like features, generally carrying a minimum term of 10 years.

Debt Capital Investments.

Debt Capital Investments are loans to FCLF that pay interest to the investor, and can take one of two forms. Term investments pay interest annually over a specific time period, usually 5 or more years, often with options for renewal. Lines of Credit have a specific maturity date, with capital available on an as-needed basis.

Program Related Investments.

Foundations may want this type of investment to support FCLF activities that match their philanthropic mission. PRIs are long-term, low-interest rate investments, often with an option for renewal.

Loan Participation Agreements.

Investors purchase a portion of FCLF’s loan portfolio based on shared mission and interest. Investors and FCLF both participate in the risk and return of a specific loan or loans.