Florida Community Loan Fund (FCLF) is a statewide Community Development Financial Institution (CDFI). Established in 1994 as a 501(c)(3), we are a mission-based nonprofit organization dedicated to improving low-income communities throughout Florida by delivering flexible financing and staff expertise. Learn more about Our Impact.

Our lending provides various types of financing to meet the needs of nonprofit organizations and mission-based for-profit organizations that develop affordable housing, supportive housing, community facilities, and economic development projects. This financing can include loans for new construction, preservation, rehab, acquisition, lines of credit, and/or longer term permanent financing. Learn more about Borrowing from FCLF.

Our financing is made possible by FCLF's strong track record of performance and partnership with investors. These investors include financial institutions, religious organizations, foundations, government entities, nonprofits, corporations and individuals – all of which support FCLF's mission in various ways. Learn more about Investing in FCLF.

OUR CORE PURPOSE.

FCLF exists to maximize opportunities for people and places outside of the economic mainstream.

OUR VISION.

Opportunity and dignity exist for every person and community in Florida.

OUR MISSION.

Our expertise and capital make projects succesful and help organizations improve lives and communities.

We Believe In Equity

Advancing racial equity is essential to FCLF’s vision of opportunity and dignity for every person and community in Florida.

We recognize that people and communities of color have historically had profoundly imbalanced access to affordable, stable housing and essential services, including life-saving healthcare. We are committed to providing capital for organizations that serve and are led by people of color and to measuring our activities toward this pursuit.

Our History

1994

FCLF was founded to support community development across Florida. FCLF Founding Board Member Sister Mary Heyser of the Religious of the Sacred Heart of Mary inspired leaders statewide to capitalize “the Loan Fund.”

1996

Under the wisdom and leadership of our founders, FCLF became Florida’s first statewide certified CDFI. We made our first loan for $50,000 to provide 7 single family homes for low-income households.

2004

FCLF became certified as a Community Development Entity (CDE) by the U.S. Dept. of Treasury and began our New Markets Tax Credit program. The NMTC program continues to have a high impact on economic development and jobs creation.

2009

Coming out of the Great Recession strong than ever, FCLF remained patient and persistent as we worked alongside community developers. We also received our first major support from the State of Florida to preserve affordable multifamily housing.

2014

2014 was a record-setting year for FCLF, as we deployed over $45 million in financing in a single year – a number that has continued to increase in subsequent years. In 2014, FCLF was one of 3 CDFIs awarded the national Wells Fargo NEXT Opportunity Award.

2018

By 2018, FCLF's total assets had grown to $71 million through management of our loan portfolio improving low-income communities. We were recognized for our hard work and impact with an NMTC Allocation award and a CDFI Award including Florida's only award for HFFI (Healthy Food Financing Initiative) and Disability Finance.

2022

FCLF continues to grow and evolve with net assets totaling $108 million and 411 loans closed. Over the past 2 years we reacted swiftly to the threat of the COVID-19 pandemic, creating emergency relief loan programs for FCLF borrowers, and partnering with fellow CDFI CRF to offer Paycheck Protection Program loans.

OUR IMPACT

All FCLF-financed projects have a direct social impact on the low-income communities we serve.

PUBLICATIONS AND RESOURCES

Need additional information? Here are PDF documents and links to affiliated organizations.

Our Team

FCLF’s Team consists of individuals dedicated to maximizing opportunities for people and places outside the economic mainstream. We are committed to putting our expertise to work to make projects successful and help organizations improve lives and communities.

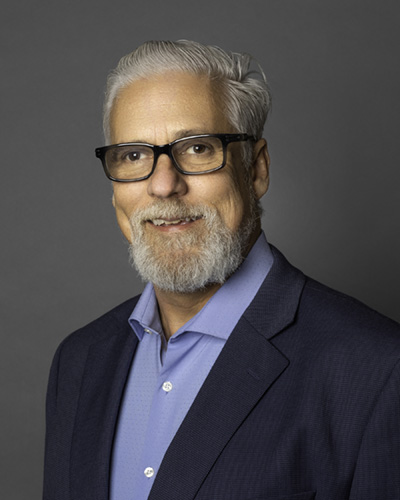

Ignacio Esteban

-

Chief Executive Officer

Ignacio Esteban is Chief Executive Officer of the Florida Community Loan Fund, a statewide nonprofit community development financial institution providing capital and expertise to help community development projects succeed throughout Florida. Mr. Esteban joined the organization in 1997 and has led the organization since 2000; during that time FCLF has increased its financing from $2.3 million to $560 million including NMTC financing. Mr. Esteban develops and executes strategic direction and oversees the lending, finance, government relations, marketing, and development functions of the organization. Esteban has 27+ years of experience at the local, state and national level in the field of community development finance. Former Board Chair for Opportunity Finance Network, he serves and has served on Community Advisory Committees and NMTC Advisory Committees for several major banks. He was appointed by Orange County Mayor Jerry Demings to the Housing for All Task Force that recommended a 10 year housing strategy. A native of Puerto Rico, Mr. Esteban earned a degree in Finance and Business Administration from the University of Central Florida, and holds an MBA from Rollins College, where he was the 2005 recipient of the Martin L. Bell Scholarship.

Carelle Bailey

-

Finance Associate

Carelle Bailey started with FCLF in 2011, and supports all aspects of our Finance Department including audit and compliance. She has over 16 years’ experience in accounting, banking and finance and has worked in the areas of travel and investment. Ms. Bailey earned a degree in Accounting from Florida Metropolitan University, and an MBA from Everest University.

Nelson Black

-

Chief Lending Officer

Mr. Black oversees all aspects of the Florida Community Loan Fund lending program, which includes its allocations of $362 million in Federal and State New Markets Tax Credits for community facilities and economic development; its $140 million in loan capital for commercial loans to support community and economic development in Florida. As Chief Lending Officer, Mr. Black has the primary responsibility for the organization's credit policies, loan production and for risk management in lending. He supervises the lending and portfolio management staff of the organization in its Tampa, Ft. Lauderdale, and Orlando locations.

Mr. Black began work for the Loan Fund in 2001. For 11 years prior to that, he specialized in the community development field for First Union National Bank. During that time, he assisted in the creation of several local SHIP affordable housing programs. Mr. Black also spearheaded the development of numerous loan programs, credit counseling programs and home ownership programs which brought together key nonprofit and government partners. He also provided integral assistance in the creation of 4 community development nonprofits across Florida. Currently, Mr. Black is a member of the Board of the New Markets Tax Credit Coalition, a national advocacy organization. He received his BA from the University of Florida in 1975.

As the Chief Operating and Strategic Initiatives Officer (COSIO), Lori Crane has responsibility for working in partnership with the senior leadership team and department managers at all levels to execute the Strategic Plan to deliver on the goals of the plan, implement new processes and approaches, achieve plan goals, and strengthens internal capacity. Crane manages the human resources functions and provides operational leadership presence for all staff. She identifies, then leads and implements new initiatives, manages FCLF’s IT functions and facilities needs, and takes a lead role in External Communications.

Crane joined FCLF in 2024 and has 25 years experience working in both the nonprofit community development field and in business development with the iconic fortune 500 company, Starbucks. Crane’s diverse experience provides a unique lens toward operating expertise, leadership, developing and executing strategic vision, human capital management, partnership and Board development, and identifying, leading and implementing new initiatives. She holds an MBA from Rollins College, where she graduated summa cum laude and was awarded membership into the prestigious international business honor society Beta Gamma Sigma.

Janet de Guehery

-

Communications & Marketing Manager

As Communications and Marketing Manager, Janet de Guehery develops and implements branding and marketing strategies and programs for Florida Community Loan Fund. She is responsible for communications with investors, supporters, borrowers, and policy makers, ensuring consistent messaging across all channels and platforms, including materials for print and web. She works closely with all departments to actively promote the success and positive impact of FCLF borrowers in Florida communities. Ms. de Guehery joined FCLF in 2007, with over 25 years of experience ranging from small family-owned businesses to multi-million dollar corporations, both for profit and non-profit. Her knowledge across the fields of marketing, administration, and accounting enables her to see the complete picture in FCLF's lending transactions from beginning to end. Ms. de Guehery is a graduate of the University of South Florida.

Jamaal R. Dickens

-

Director of Finance

As Director of Finance, Jamaal R. Dickens manages the general accounting, financial reporting, audit activities, financial analysis and forecasting, and asset management requirements for the organization.

Mr. Dickens joined FCLF in 2023, bringing more than 15 years of experience in the areas of financial management and analysis, nonprofit and for-profit accounting, contract procurement and negotiations, governmental budgeting, and federal grant reporting. His managerial background includes Controller and Contracts Director roles within various nonprofit organizations, healthcare finance and for-profit corporations, as well as finance and accounting roles with State of Florida governmental entities, such as the Florida Department of Education, the Florida State Board of Administration, and the Florida College Prepaid Board.

Mr. Dickens holds an MBA from Florida Atlantic University’s College of Business, as well as Bachelors degrees in Accounting and Business Administration from Flagler College. Dickens is also a Lean Six Sigma Green Belt, specializing in improving efficiency in operational processes.

Veronica Howze

-

Loan Portfolio Administrator

Veronica Howze is a member of the loan administration team that is responsible for servicing FCLF's diverse portfolio of community and economic development loan programs. Ms. Howze works with loan officers to prepare loan documents, oversee execution of loan and other documents, administer construction draw disbursements, review covenant compliance issues and maintain loan file documentation. Veronica joined FCLF in April 2024 with over 30 years of experience in the financial services industry, specifically with various Credit Unions including Vystar and Community First. She has an extensive background encompassing commercial and consumer loan origination, underwriting, loan servicing, portfolio management, and credit administration.

Michael Jones

-

Community Development Loan Officer

As a Community Development Loan Officer, Michael Jones underwrites community and economic development loans for Florida Community Loan Fund's commercial loan programs. Mr. Jones also provides technical assistance to borrowers throughout Central and Southwest Florida. Mr. Jones brings 7 years of commercial banking experience to FCLF having served in both administration and, most recently, portfolio management/ underwriting roles at both Truist and SouthState Bank. Mr. Jones underwrote both commercial and industrial and commercial real estate loans during his time at those institutions and is committed to using that experience to help low income communities throughout Florida. Mr. Jones is a 2015 graduate of UCF and has been a Florida resident since moving from Detroit, MI in 1996.

Angela Kisling

-

Loan Portfolio Administrator

Angela Kisling is a member of the loan administration team that is responsible for servicing FCLF's diverse portfolio of community and economic development loan programs. Ms. Kisling works with loan officers to prepare loan documents, oversee execution of loan and other documents, administer construction draw disbursements, review covenant compliance issues and maintain loan file documentation. Ms. Kisling joined FCLF in 2019 with 17 years’ experience in banking with an emphasis on commercial real estate lending, document preparation, commercial appraisal review and residential appraisal review. Prior to her relocation to central Florida in 2012, Ms. Kisling was a licensed Realtor for 10 years.

Willa Maddox

-

Grants Coordinator

Willa Maddox joined FCLF in 2016 as the Grants Coordinator. Willa works with senior staff and other departments to prepare, assemble, and submit major federal and state grant applications, and assists in writing and securing grants from foundations and corporate donors. In this role, Willa ensures proposals are formatted, packaged, and submitted in accordance with granting agency requirements, and also evaluates current applications for changes and new content, develops timelines, authors original drafts, maintains databases, and assists in compliance and reporting. Willa holds a Bachelor of Science in Public Administration, with focuses in both Nonprofit Management and Writing & Rhetoric, from the University of Central Florida.

Anna Upchurch Pernell

-

Community Development Loan Officer

As a Community Development Loan Officer, Anna Upchurch Pernell underwrites community and economic development loans for Florida Community Loan Fund's commercial loan programs. Mrs. Pernell also provides technical assistance to borrowers throughout Central and North Florida. Mrs. Pernell brings 10 years of private sector experience in analytical, corporate sales and marketing roles to FCLF, in addition to 5+ years experience working with CDFIs and nonprofit organizations to promote underserved small businesses, community development, and community engagement. While working for the International Rescue Committee, a refugee resettlement agency, in their Salt Lake City office, and for a small business CDFI in Aurora, CO, CEDS Finance, Mrs. Pernell provided both capital and technical assistance to underserved entrepreneurs with a focus on community engagement and tailored technical assistance. Mrs. Pernell received her BSBA from the University of North Carolina at Chapel Hill and an MPA, with a focus on nonprofit management, from the University of Colorado Denver.

Mrs. Pernell is driven by creating equitable opportunities in communities outside of the economic mainstream. Across Central and Northwest Florida she delivers loan capital to nonprofits and mission-driven for-profit developers of affordable housing, supportive housing, and facilities to meet FCLF's mission.

Jessica Polk

-

Senior Loan Portfolio Administrator

Jessica Polk is a member of the loan administration team that is responsible for servicing FCLF's diverse portfolio of community and economic development loan programs. Ms. Polk works with loan officers to prepare loan documents, oversee execution of loan and other documents, administer construction draw disbursements, review covenant compliance issues and maintain loan file documentation. Ms. Polk joined FCLF in 2017, with over 12 years of experience in banking with an emphasis on commercial real estate lending, construction loans and asset based lending. She has held various officer positions in banking for over 8 years and has experience with training in loan documentation, LaserPro/LawyerPro loan software and banking operations. Ms.Polk majored in Finance with a concentration in Real Estate and a minor In Political Science from Louisiana State University.

Jennifer Rainey

-

Loan Portfolio Manager

Jennifer Rainey manages the loan administration team that is responsible for all servicing of the Florida Community Loan Fund's community and economic development loan programs. Her team's work covers commitment letters, title and survey issues, internal preparation of loan documents, loan closings, administration during construction (including analysis and approval of draw requests), performance of site inspections and customer visits. The loan administration team also maintains the loan servicing system providing invoicing, loan history information, reporting functions and social impact tracking. Jennifer provides overall credit review assistance and support to the entire lending team. Jennifer’s team also supports FCLF's New Markets Tax Credit (NMTC) Program, screening and verifying site and project qualifications to establish NMTC pipeline. Her teammates represent FCLF's real estate and commercial loan interests during NMTC structure closings, and during project construction and disbursement. Jennifer joined FCLF in November 2021, bringing with her over 35 years’ experience in the banking and finance industry. Prior to joining FCLF, she was employed at Truist Bank in the role of commercial Credit Operations Senior Manager and Bank of America as a Regional Office Administration Manager. She has an extensive background in all aspects of commercial real estate loan transactions. She earned both her Bachelor of Arts and Masters of Arts from Rollins College in Winter Park.

Narine Ramtahal

-

Loan Portfolio Administrator

Narine Ramtahal is a member of the loan administration team that is responsible for servicing FCLF's diverse portfolio of community and economic development loan programs. Mr. Ramtahal works with loan officers to prepare loan documents, oversee execution of loan and other documents, administer construction draw disbursements, review covenant compliance issues, and maintain loan file documentation. Mr. Ramtahal joined FCLF in 2021, with over 20 years of experience in banking with extensive experience in both consumer and commercial banking. Before relocating to Florida in 2020, he worked for a large New York based commercial bank that specialized in commercial real estate lending, construction loans and syndication lending.

Dwayne Rankin

-

Community Development Loan Officer

As a Community Development Loan Officer, Dwayne Rankin underwrites community and economic development loans for Florida Community Loan Fund's commercial loan programs. Mr. Rankin also provides technical assistance to borrowers throughout Tampa, West and Southwest Florida. Mr. Rankin brings 20+ years of commercial lending, economic development finance and community development expertise to FCLF. His experience includes working for both not-for-profit lending organizations and regional banks. Mr. Rankin worked as a Relationship Manager for Citizens Bank, a regional bank based in Providence Rhode Island, where he helped large corporate clients by providing commercial and industrial loans, commercial real estate loans, and a host of banking services. He also worked as the Chief Lending Officer for Bridgeway Capital, a Community Development Financial Institution based in Pittsburgh Pennsylvania, where during his nearly 8 years with the organization helped to invest $100 million into low-income communities.

Mr. Rankin is dedicated to helping to bring opportunity and dignity to people and places outside the economic mainstream. He facilitates projects for both nonprofits and mission-oriented for-profit clients while supporting FCLF’s goal of providing expertise and capital to improve lives and communities.

Shanté Riley

-

Executive Assistant & Office Manager

As Executive Assistant and Office Manager, Ms. Riley provides administrative support to the Chief Executive Officer, Senior Management Team, and staff in all FCLF offices. Ms. Riley also operates as the liaison for all office systems in IT, Human Resources, and telecommunications. On a day-to-basis, Ms. Riley functions in various capacities, preparing and scheduling meetings for Board, Committee, and Senior Management; maintaining up-to-date records of permanent corporate files; and providing general oversight of the office work environment. Ms. Riley joined FCLF in 2023 and brings five years of experience in Marketing and Administration from Trademark & Business Law offices; universities; and nonprofits. Shanté also humbly served as the President & Founder of Helping the Homeless Project caring for the local homeless population in upstate New York. Ms. Riley holds a Bachelor of Arts in Philosophy Politics, and Law and an Associate of Arts in Math and Science Honors.

Rich Rollason

-

Development Officer

Rich Rollason joined FCLF in March 2009. In his role as Development Officer, he works to strengthen partnerships with financial institutions, foundations, and religious organizations, identifying opportunities to achieve shared community development goals throughout Florida. He plays a key role in securing the capital necessary to support FCLF's loan programs, engaging with bank and foundation representatives, drafting grant proposals and participating in outreach efforts to raise awareness about the organization's mission and impact. Additionally, Mr. Rollason serves as a board member for Florida Prosperity Partnership. Beyond his professional responsibilities, he is an active member of his community, volunteering for service projects and coaching youth sports teams. Mr. Rollason graduated from Valdosta State University.

Tammy Thomas

-

Chief Financial Officer

Tammy Thomas joined Florida Community Loan Fund in August 2006. As CFO and member of the senior management team, Tammy is responsible for overall risk and asset management of the organization, accounting practices, financial and compliance reporting, budget preparation, tax and audit functions. She provides fiscal oversight and monitors capital deployment and loan portfolio risk. She is instrumental in negotiating investment terms and covenants, administration of closings, and oversight of all investor and CDFI Fund compliance reporting. In her tenure with FCLF, capital under management has grown from $38MM to $336MM. Ms. Thomas is responsible for asset management and loan servicing for FCLF’s $183MM NMTC portfolio.

Thomas has 25 years of experience in accounting, financial management, contract administration, and compliance reporting. Her extensive management background is the result of experience from both non-profit and for-profit industries, including membership associations, legal, and manufacturing. Ms. Thomas earned a degree in Finance and Business Administration from the University of Central Florida and an MBA from Crummer Graduate School of Business at Rollins College. She has participated on the Performance Counts working group, a CDFI industry-led collaborative effort to develop industry standards and best practices around financial statements and financial management. In 2014, Ms. Thomas was selected to participate in The Citi Leadership Program for Opportunity Finance.

Christian Thompson

-

Senior Loan Portfolio Administrator

Christian Thompson is a member of the loan administration team that is responsible for servicing FCLF's diverse portfolio of community and economic development loan programs. Mr. Thompson works with loan officers to prepare loan documents, oversee execution of loan and other documents, administer construction draw disbursements, review covenant compliance issues and maintain loan file documentation. Mr. Thompson joined FCLF in 2015, with nearly 20 years of experience in banking with an emphasis on commercial real estate lending as well as construction loan administration.

Jim Walker

-

Senior Community Development Loan Officer

As Community Development Loan Officer, Jim Walker underwrites community and economic development loans for Florida Community Loan Fund's commercial loan programs and provides support to FCLF's New Markets Tax Credit (NMTC) Program. Mr. Walker also provides technical assistance to borrowers throughout South and Southeast Florida. Mr. Walker joined the Florida Community Loan Fund in 2010, bringing 25 years of community development finance and lending experience including structuring financing for multi-family housing, charter schools, community health clinics, and Historic and NMTC revitalization projects. Mr. Walker has served on Capitol Hill, where he was responsible for budgeting and international finance and development issues.

He is currently Vice-Chair of the Board of the Housing Leadership Council of Palm Beach County and serves on the board of several nonprofits. Mr. Walker received his BA from Harvard College and an MBA from Columbia University where he graduated in the top 5% of his class and was awarded membership to Beta Gamma Sigma, the academic honor society. He is a native South Floridian.

Hear From Our Partners

"BankUnited understands the challenges facing our communities; we applaud FCLF's efforts. Thank you for making our community a better place to live." – Katrina Wright, VP Comm. Dev.

BankUnited

"FCLF understands and is a part of what we are doing: helping families have the American dream of owning a home." – Isaac Simhon, Executive Director

Housing Programs, Inc.

"Partnering with FCLF helped us lower costs and maintain our construction schedule… helping us serve more families, more efficiently." – Catherine Steck McManus, President & CEO

Habitat for Humanity Greater Orlando …

“With FCLF’s invaluable assistance, HBH was able to realize a transformative vision that is a game-changer for our community."– John Aquino, Dir. of Admin

Henderson Behavioral Health

“FCLF does more than finance deals; they make true community investments."– Mandy Bartle, Executive Director

South Florida Community Land Trust

"We commend the important work of your organization, are glad to support its efforts." – Beverly Dabney

JPMorgan Chase Foundation

“The collaboration between Evara Health and FCLF stands as a testament to what can be achieved through strategic partnerships and innovative financing."– Edward Kucher, Chief Regulatory Officer

Evara Health

"FCLF plays a significant role in sustaining vibrant and thriving communities. We are pleased to support your ongoing community based efforts." – Ernie Diaz, South Florida Market President

TD Charitable Foundation

“Thank you FCLF for assisting me with this project. Soon we will have affordable housing ready, and the community is proud to welcome new families."– Robyn Yant, Owner & Founder

Impactful Investment Partners

Partnering with FCLF allows PNC to help build strong communities. - Aileen Pruitt, Florida Market Manager, PNC Community Development Banking

PNC Bank

"FCLF is very focused on bringing financing to affordable housing. Stability in these households brings stability to the entire community." – Jonathan Wolf, President & Founder

Wendover Housing

“Expanding our facility with NMTC financing provides the Overtown community resources necessary to provide a fighting chance to break down barriers and break the cycles of poverty.” – Tina Brown, CEO

OYC Miami

“Our partnership with FCLF makes an enormous difference in overcoming the challenge of providing affordable housing." – Jo Ann Nesbitt, President/CEO

St. Jude Great Commission CDC

“FCLF addresses local community needs, which aligns with our core values. We appreciate your commitment to our communities.” – Mellissa Slover-Athey, Comm Reinv Ofcr

CenterState Bank

"Thanks to FCLF on behalf of the many women and children served by our team. We have seen thousands of lives changed and NMTC financing was an extraordinary boost." – Constance Collins, Presi

Lotus Village

"Trinity Health is happy to partner with FCLF. We look forward to seeing the impact in the communities you serve." – Sr. Kathleen Coll, SSJ, Administrator, Shareholder Advocacy

Trinity Health

"This renovation marks a significant milestone in our 38-year history. We are grateful for FCLF's support and for helping us further our mission." – Nina Yon, President & CEO

The Sharing Center

“Affordable housing is an issue that needs our full attention. This grant, along with the efforts of FCLF, will help inspire and build better lives and communities." – Steve Fisher, Regional Pres

Truist

"We are proud to continue our support of the Florida Community Loan Fund." – Jodie Hardman, SVP, Marketing Mgr, Corp Social Responsibility

Bank of America

"This renovation is an investment in the community we have served for 25 years. We are tremendously grateful to FCLF for boldly supporting us." – Ed Durkee, President & CEO

Goodwill Industries of Cent. Florida

Core Purpose FCLF exists to maximize opportunities for people and places outside of the economic mainstream.

Our Vision Opportunity and dignity exist for every person and community in Florida.

Our Mission Our expertise and capital make projects successful and help organizations improve lives and communities.

Sign Up for our Newsletter

©2024 FCLF - Florida Community Loan Fund, Inc. | Privacy Policy | Sitemap